Rising cost of living forces Canadians to make tough sacrifices: Three in 10 are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

Burdened by high living costs, Canadians are making difficult sacrifices and finding ways to share expenses to make ends meet. According to the latest MNP Consumer Debt Index, conducted quarterly by Ipsos, nearly a third (30%) of Canadians say they have turned to bill-splitting strategies — such as carpooling, buying in bulk, sharing subscriptions, and childcare. More than one in 10 (13%) are saving money by moving in with friends, partners, or family members, or seeking additional roommates or co-living spaces. Nearly three in 10 (28%) Canadians say they’ve even resorted to eating less to save money.

“We’re witnessing a bill-splitting boom as Canadians adapt to the high cost of living. Strategies like sharing expenses and co-living arrangements showcase not only the resourcefulness of many households but also the financial pressures they’re facing,” says Grant Bazian, President of MNP LTD, the country’s largest insolvency firm. “These measures reflect the harsh reality of soaring living costs, compelling Canadians to find new ways to save. It's particularly concerning that nearly three in 10 report cutting back on food to make ends meet.”

Details behind MNP’s Consumer Debt Index, along with media coverage and our provincial and national news releases can be found below. To view data from previous releases of the MNP Consumer Debt Index, visit our Historical Data page.

Debt Index Results for October 2024

Press Releases

- National: Rising cost of living forces Canadians to make tough sacrifices: Three in 10 are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- B.C.: Rising cost of living forces British Columbians to make tough sacrifices: more than one-third are eating less to save money

- Ontario: Rising cost of living forces Ontarians to make tough sacrifices: More than a quarter are eating less to save, sharing expenses from housing to carpooling, childcare, and groceries

- Saskatchewan: Rising cost of living forces Saskatchewan and Manitoba residents to make tough sacrifices: More than a quarter are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- Alberta: Rising cost of living forces Albertans to make tough sacrifices: More than one-third are eating less to save, sharing expenses from housing to carpooling, childcare, and groceries

- Nova Scotia: Rising cost of living forces Nova Scotians to make tough sacrifices: Three in 10 are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- New Brunswick: Rising cost of living forces New Brunswickers to make tough sacrifices: Three in 10 are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- Newfoundland: Rising cost of living forces Newfoundland and Labradorians to make tough sacrifices: Three in 10 are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- Prince Edward Island: Rising cost of living forces Prince Edward Islanders to make tough sacrifices: Three in 10 are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- Manitoba: Rising cost of living forces Manitoba and Saskatchewan residents to make tough sacrifices: More than a quarter are eating less to save, sharing expenses from housing to carpooling, childcare and groceries

- Quebec: Rising cost of living forces Quebecers to make tough sacrifices: One in five are eating less to save; nearly a third are sharing expenses from housing to carpooling, childcare, and groceries

Subscribe to MNP Consumer Debt Index

Stay in the know! Get notified by email when the next Consumer Debt Index is released.

Subscribe to MNP Consumer Debt Index arrow_forwardArchives

Browse through our previous MNP Consumer Debt Index results.

Archives arrow_forwardAbout MNP LTD

MNP LTD, a division of the national accounting firm MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 240 offices from coast to coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit MNPdebt.ca to contact a Licensed Insolvency Trustee or use our free Do it Yourself (DIY) debt assessment tools. For regular, bite-sized insights about debt and personal finances, subscribe to the MNP 3-Minute Debt Break Podcast.

About the MNP Consumer Debt Index

The MNP Consumer Debt Index measures Canadians’ attitudes toward their consumer debt and gauges their ability to pay their bills, endure unexpected expenses, and absorb interest-rate fluctuations without approaching insolvency. Conducted by Ipsos and updated quarterly, the Index is an industry-leading barometer of financial pressure or relief among Canadians.

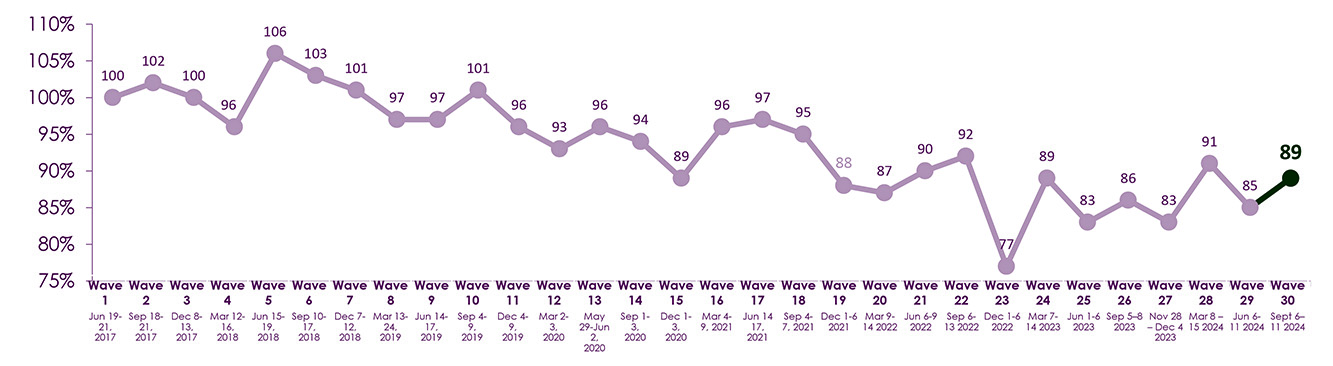

Now in its thirtieth wave, the Index has increased to 89 points, up four points since last quarter. Visit MNPdebt.ca/CDI to learn more.

The data was compiled by Ipsos on behalf of MNP LTD between September 6 and September 11, 2024. For this survey, a sample of 2,000 Canadians aged 18 years and over was interviewed. Weighting was then employed to balance demographics to ensure that the sample's composition reflects that of the adult population according to Census data and to provide results intended to approximate the sample universe. The precision of Ipsos online polls is measured using a credibility interval. In this case, the poll is accurate to within ±2.5 percentage points, 19 times out of 20, had all Canadian adults been polled. The credibility interval will be wider among subsets of the population. All sample surveys and polls may be subject to other sources of error, including, but not limited to, coverage error and measurement error.

Latest Consumer Debt Index Blog Posts

2024-10-30

Budgeting 101: 5 simple steps for a good budget

Lifestyle Debt

Follow these 5 steps and you’ll be well on your way to turning a good budget into a good habit.