Half Of Albertans Anticipate Feelings Of Anxiety And Regret Over Holiday Spending

Half of Albertans anticipate feelings of anxiety and regret over holiday-spending

Albertans admit to bad financial habits including:

- Being lured in by deals or offers by companies on days such as Black Friday, Boxing Day, etc. (20%)

- Paying only the minimum balance on a credit card (27%) or line of credit (20%)

- Borrowing money they can’t afford to pay back quickly (16%)

- Making a major purchase on credit without paying it off right away (14%)

- Buying something on credit that requires no payments for a while (12%)

CALGARY, AB – As the shopping rush reaches peak intensity before the holidays, a local debt expert is warning Calgarians to avoid taking on more debt or payday loans, as they try to cope with the pressures of last minute gifts and Christmas grocery shopping.

“During the holidays is when people really feel the pressure mounting, and are tempted to overextend themselves on credit cards or even borrow money from a payday lender. They can easily get caught in a cycle of debt, because of the extremely high interest rates on these types of credit,” says Zaki Alam, a Licenced Insolvency Trustee at MNP Ltd.

A new poll conducted by MNP on behalf of Ipsos highlights some bad financial habits that are exacerbated by the holiday shopping season. One in five (20%) admit to being lured in by sales on ‘deal’ days like Black Friday or Boxing Day. Slightly more than one in ten (12%) said they have bought something on credit that requires no payments for a while.

“This is a constant bombardment of sales and ‘buy now, pay later’ offers this time of year. Unfortunately, what might seem like a small purchase or look like a great Boxing Day deal won’t really be such a bargain if you end up carrying them on credit,” says Zaki.

Three in ten Albertans (27%) admit to only paying the minimum balance on their credit card or line of credit (20%). Nearly fifteen percent (14%) say they have made a major purchase on credit without paying it off right away. About the same number (16%) say they borrowed money they can’t afford to pay back quickly. Nearly one in ten (9%) admit they have even used their home-equity line of credit to buy things they want but don’t need.

“It’s important to fully understand the true cost of your debt, if you do decide to borrow or use credit cards. You need to calculate the potential interest accrued and add that to the sticker price of the item you want. Suddenly that ‘deal’ will likely be far less enticing,” says Zaki.

Come January, Albertans anticipate feeling the effects of a credit hangover. Last year, half (50%) felt anxiety over the arrival of holiday-spending bills, and regret over how much they spent (49%). However, the same number (49%) say they made it their New Year’s resolution to get their finances back on track.

“Resolve to get a better hold on your finances right away. Don’t wait until the New Year, when the bills arrive. Start by making a plan to tackle debt repayment obligations and seek advice from a professional if holiday and other accumulated debts are leaving you overwhelmed. The most important thing you can do right now is to spend less and make a conscious effort to shop thoughtfully. Remember: the holidays are more about your presence than the presents,” advises Zaki.

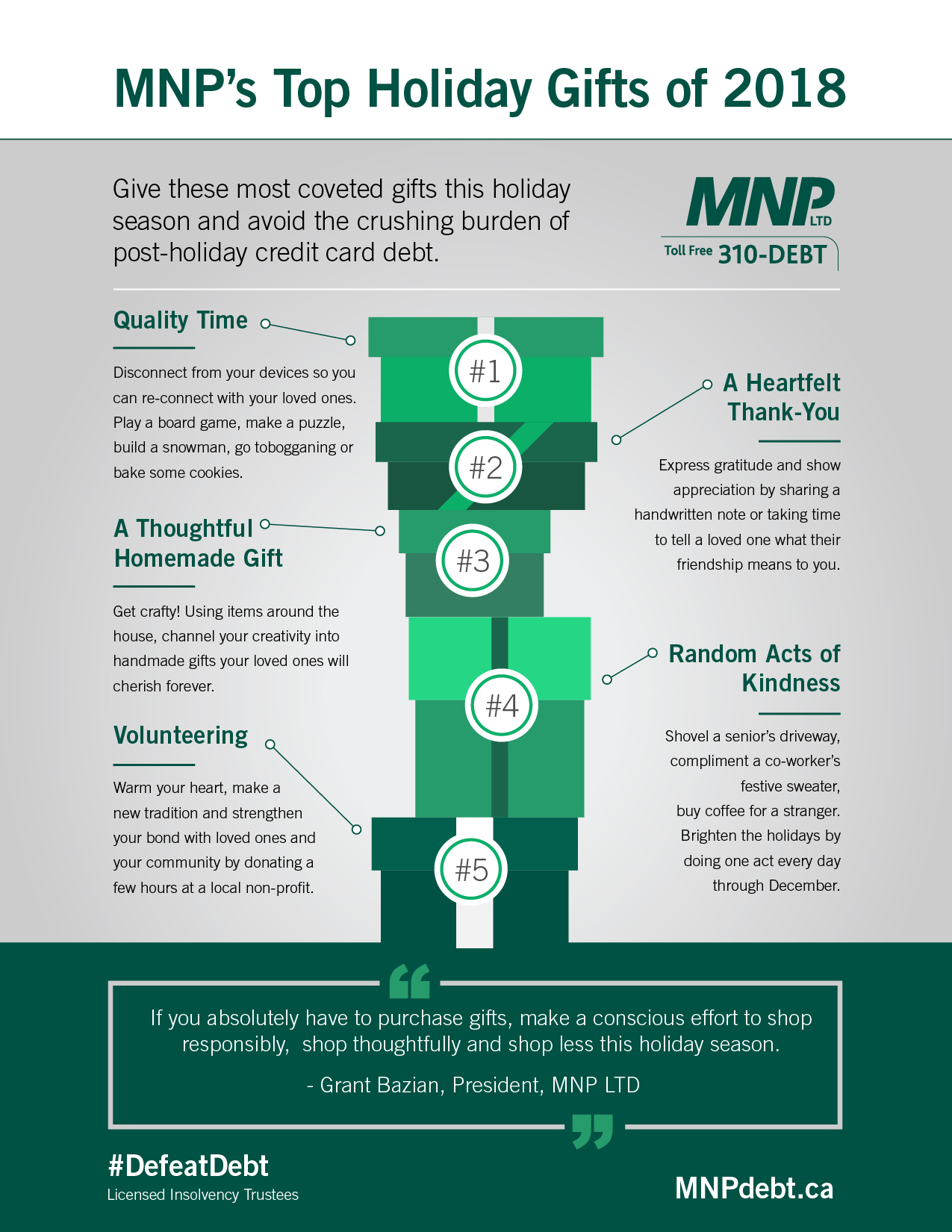

With the holiday spirit in mind, MNP Ltd, has re-released an ‘un-shopping’ holiday gift guide designed to help minimize the crushing burden of post-holiday debt.

MNP’s Holiday Gift Guide - 2018

It’s about your presence, not the presents!

1. Quality time

One of the best gifts you could give someone is your time. Spending valuable time with your loved ones creates more meaningful memories. Disconnect from your devices so you can re-connect with your loved ones. Play a board game, make a puzzle, build a snowman, go tobogganing or bake some cookies. Volunteer to babysit your nieces and nephews while their parents get that much needed break or spend time together as a family cooking a holiday meal.

2. A heartfelt ‘thank you’

In a time where emails and messages are the preferred means of communication, take the time to express gratitude and show appreciation by sharing a handwritten note or telling a loved one what their friendship means to you.

3. Thoughtful homemade gifts

Bring out the creative side in you and make a gift for your loved ones. Not only can you create something they are sure to love, but you can also customize it to suit their taste. Between Pinterest and Youtube you’ll find all the inspiration you need to unleash your creativity, and build something your loved ones are sure to cherish for a long time.

4. Volunteering

Nothing boosts your spirits and makes you feel as great as helping someone in need. Make a new tradition with family or your group of friends and donate a few hours at a local non-profit to help those in need.

5. Random acts of kindness

Shovel your neighbour’s driveway, compliment a co-worker’s festive sweater, and offer to help with cooking or baking. You can brighten the holidays by generously giving your time for random acts of kindness.

About MNP LTD

MNP LTD, a division of MNP LLP, is the largest insolvency practice in Canada. For more than 50 years, our experienced team of Licensed Insolvency Trustees and advisors have been working with individuals to help them recover from times of financial distress and regain control of their finances. With more than 230 Canadian offices from coast-to-coast, MNP helps thousands of Canadians each year who are struggling with an overwhelming amount of debt. Visit www.MNPdebt.ca to contact a Licensed Insolvency Trustee or get a free checkup for your debt health using the MNP Debt Scale.

About the Survey

The survey was compiled by Ipsos on behalf of MNP LTD between December 7 and 12, 2018. For this survey, a sample of 2,154 Canadians from the Ipsos I-Say panel was interviewed online. The precision of online polls is measured using a credibility interval. In this case, the results are accurate to within +/- 2.4 percentage points, 19 times out of 20, of what the results would have been had all Canadian adults been polled. Credibility intervals are wider among subsets of the population.