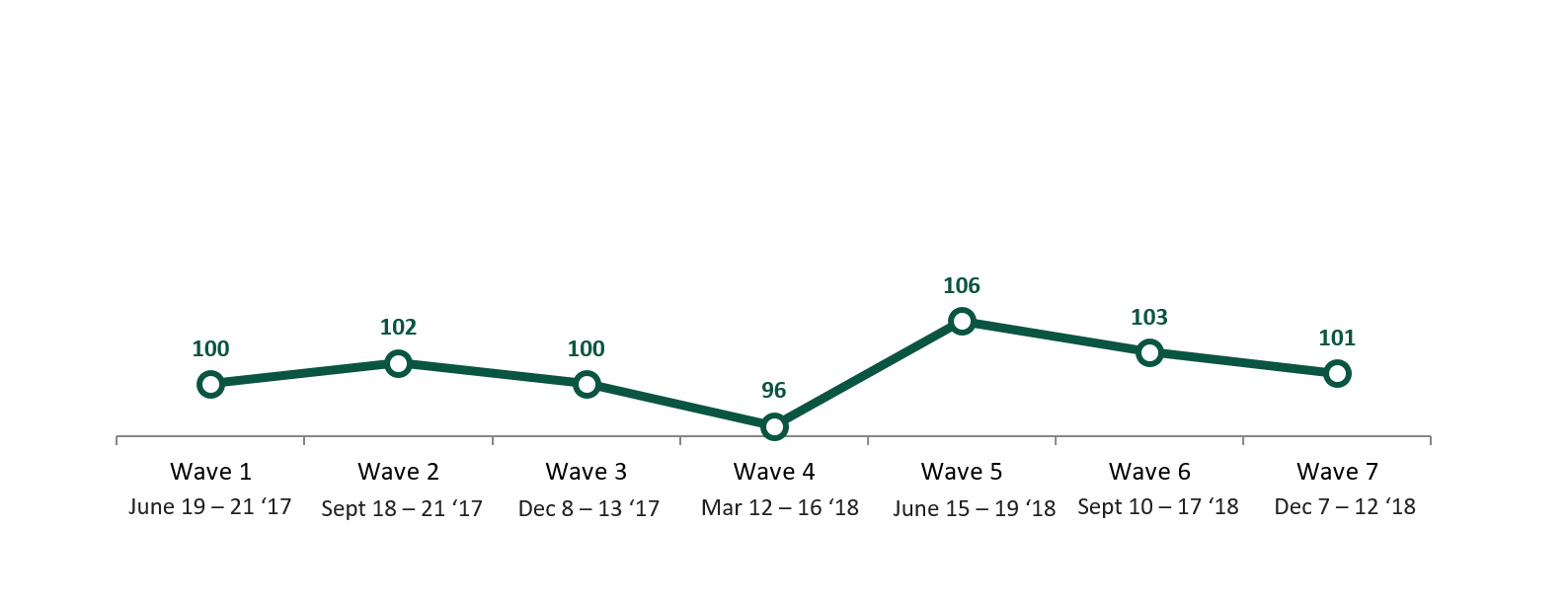

MNP Consumer Debt Index January 2019 Results Summary

Canadians significantly more worried about debt, interest rates and personal finances compared to September.

According to a recent Ipsos poll conducted by MNP LTD., a growing number of Canadians are inching closer to insolvency – with the proportion who are $200 or less from being able to pay their bills each month (46%) rising six points since September.

Three in ten now say they don’t earn enough to cover their bills and debt payments – a seven percent increase over the same period – and nearly half (45%) say they will need to go further into debt over the next year just to pay for their living and family expenses. Fewer than four in 10 say they’re confident they could cope financially with an unexpected or life-changing event.

Debt Index Results January 2019

Press Releases

- National: Canadians significantly more worried about debt, interest rates and personal finances compared to September

- B.C.: Six in ten British Columbians are concerned about their ability to repay debt, up 10 points since September

- Ontario: More than half of Ontarians say they are feeling the effects of interest rate increases, up 10 points since September

- Saskatchewan: Over Half of Saskatchewan and Manitoba Residents are $200 or Less Away from Financial Insolvency After Paying their Monthly Bills and Debts, Up 14 points Since September

- Alberta: Number of Albertans who say they are feeling the effects of interest rate increases jumps almost 20 per cent since September

- Atlantic: Atlantic Canadians’ fears about debt, interest rates and personal finances on the decline, yet more are close to insolvency

- Manitoba: Over Half of Manitoba and Saskatchewan Residents are $200 or Less Away from Financial Insolvency After Paying their Monthly Bills and Debts, up 14 points Since September

- Click here to view an interactive infographic