Mnp Consumer Debt Sentiment Survey

Debt has many Canadians teetering on the edge of insolvency.

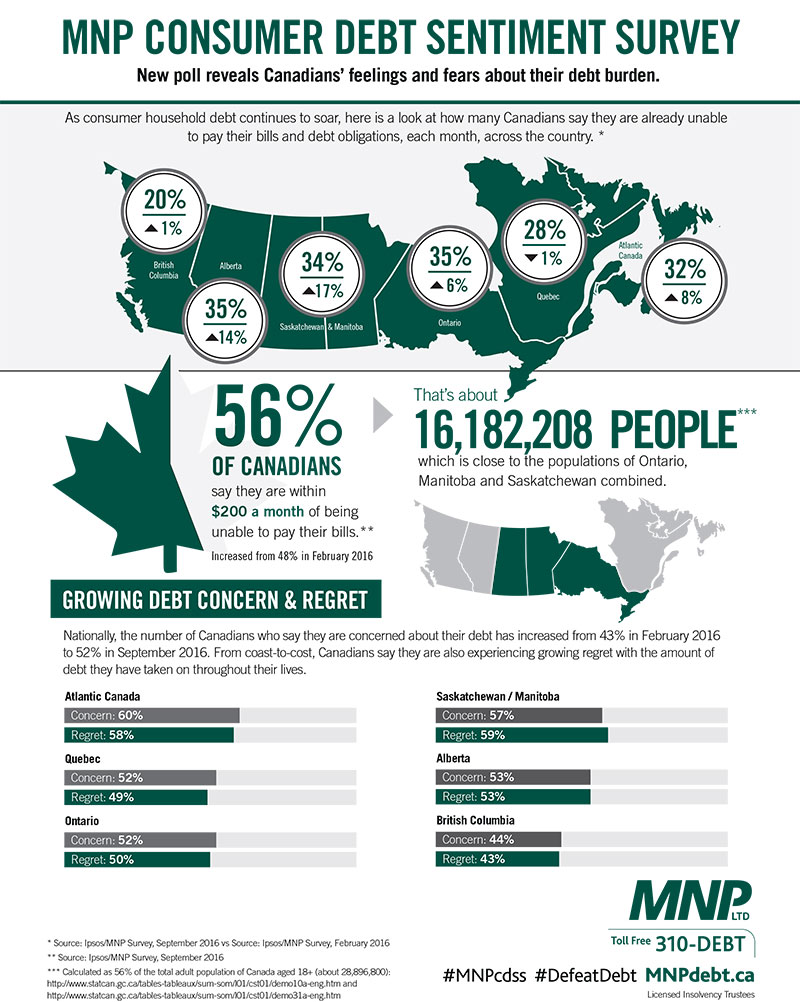

With a weakened economy, a struggling loonie and in some provinces, many facing the reality of under or unemployment, many Canadians are so financially stretched they aren’t sure how they will keep up with the day-to-day cost-of-living, let alone their debt repayments. In fact, according to a Consumer Debt Sentiment Survey conducted by Ipsos on behalf of MNP, over 50 per cent of Canadians are very close to being unable to keep up with financial obligations. Details behind the survey can be found below.

Survey Details

MNP Press Releases

- Over half of Canadians are concerned about their debt and are now living within $200 a month of being unable to pay their bills

- Sixty-four per cent of Saskatchewan and Manitoba residents say they are now living within $200 a month of being unable to pay their bills and debt payments each month

- Almost sixty per cent of Atlantic Canadians now say they are living within $200 a month of being unable to pay their bills and debt payments each month

- Concern About Debt and Potential Interest Rate Hikes Rising Among British Columbians

- Fifty-nine per cent of Ontarians say they are now living within $200 a month of being unable to pay their bills and debt payments each month

- Fifty-eight per cent of Albertans say they are now living within $200 a month of being unable to pay their bills and debt payments each month

Infographic

Press Highlights

National

- Financial Post – Canadians are just $200 away from being overwhelmed by debt, new survey finds

- BNN – Pattie Lovett-Reid: More than half of Canadians within $200 away from being unable to pay bills (Video)

- Huffington Post – Canadian Debt Levels Would Crush Them If They Were $200 Higher: Survey

- Market Wired - Over Half of Canadians are Concerned About Their Debt and are Now Living Within $200 a Month of Being Unable to Pay Their Bills

- Yahoo – Over Half of Canadians are Concerned About Their Debt and are Now Living Within $200 a Month of Being Unable to Pay Their Bills

- Ipsos Reid – One in Three (31%) Canadians Don’t Make Enough to Cover Their Bills, Up 5 Points from Early This Year

British Columbia

Alberta

- Calgary Herald – Nearly 60% of Albertans say $200 could push them over the financial edge

- 660 Ched – Almost 60% of Albertans close to insolvency

- CTV Calgary – Record High Consumer Debt in Alberta (Video)

- Global News - 35% of Albertans don’t make enough money to cover their bills, debt payments: study

- 770 Radio - Almost 60% of Albertans close to insolvency

- CTV Edmonton – Survey shows some Albertans struggling to scrape together cash to cover bills

- 660 News (Ched) – Almost 60% of Albertans close to insolvency

- 660 News - Insolvencies and debt continue to rise in Alberta

- iNews 880 – Canadians Are Now Living Within $200 a Month of Being Unable to Pay Their Bills: Poll

- Edmonton Sun - Albertans suffering serious financial problems up sharply compared to rest of Canada

Saskatchewan

Manitoba

Ontario