Trustees Offer Help For Canadians Feeling The Debt Pinch As Holiday Bills Arrive

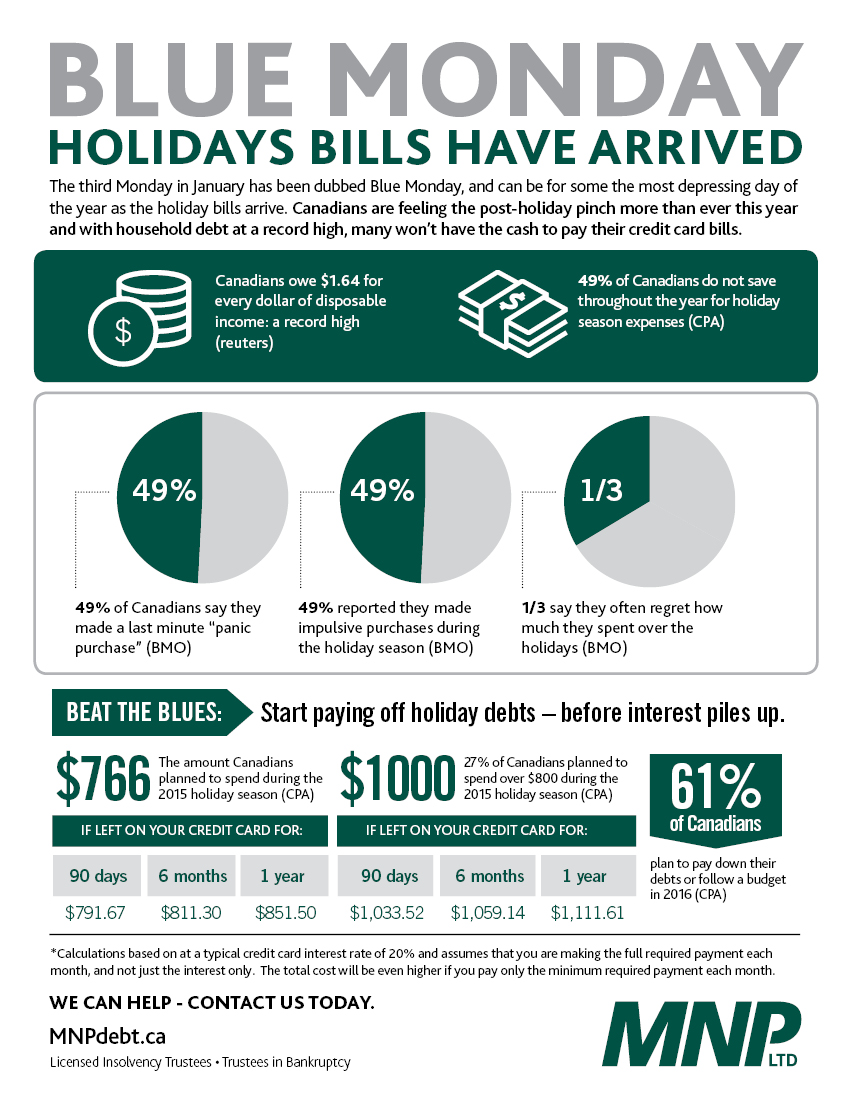

January 18, 2016, CANADA – The third Monday in January has been dubbed Blue Monday; what can be for some the most depressing day of the year as the holiday bills arrive around this time. Canadians are feeling the post-holiday pinch more than ever this year and with household debt at a record high and the low dollar already driving up grocery prices, many will struggle to pay their credit card bills.

“Canadians have been carrying record high levels of debt right through 2015 and into 2016, and now they’ll also need to manage the additional debt accumulated during the holiday season,” says Grant Bazian, a Bankruptcy Trustee with MNP Debt. “This time of year we do see many people coming into our offices to find out what their options are to get help with their debt. It certainly is a depressing reality for many but the good news is that there is help.”

Bazian offers advice for dealing with post-holiday debt:

- Open your bills and face your debt head on

- Calculate the interest you are paying

It is tempting to go into denial after the holidays, leaving bills unopened or putting off making payments. But if those purchases are left on your credit card, the interest payments can add up quickly, making that debt an even bigger burden. That is how debt snowballs and gets people into real trouble.

“Get a clear picture of exactly how much interest you’ll be paying. It will make you more motivated to pay down that debt.”

According to a poll conducted by the Chartered Professional Accountants of Canada, Canadians expected to spend $766 for holiday gifts in 2015. Here is a look at how much will be owed:

| $766 If left on credit for | Total to pay |

| 90 days | $791.67 |

| 6 months | $811.30 |

| 1 year | $851.50 |

The same poll revealed that 27 per cent of Canadians planned to spend over $800 during the holiday season. Here is a look at how much will be owed on $1000:

| $1000 If left on credit for | Total to pay |

| 90 days | $1,033.52 |

| 6 months | $1,059.14 |

| 1 year | $1,111.61 |

- Reduce or eliminate your credit card spend

- Increase your minimum payments

- Put a cap on trigger purchases

- Set up pre-pay transfers

- Take advantage of tax season

- Get help

You can’t get ahead if you’re always having to pay interest on your purchases. Do whatever you need to do to not use your credit card. It will help you financially in the long run.

Almost half of Canadians made impulsive purchases during the holiday season, causing them to overspend, a recent BMO report revealed.

A quick way to prevent extra interest charges on debts and minimize your balance is to increase your minimum payments, by an amount that your budget will allow.

If you have a tendency to overspend on certain purchases like dinners out, put a monthly cap on those specific purchases. That will allow you to control future overspending, while also freeing up extra cash to pay down your debts. Think about whether you should really make that purchase.

An electronic transfer can be set up to transfer some of your paycheque as soon as it is deposited, directly to your unpaid bills. This will help minimize interest costs that accrue daily, and effectively reduce the outstanding bill faster.

File your taxes well ahead of the deadline, and when your tax return arrives, use that lump sum to pay off the highest interest debts.

For whatever reason, people wait until they are in a crisis before seeking help. They feel they can handle it on their own, or they are embarrassed, or they are in denial. But getting professional help can resolve financial difficulties sooner and make the process of getting out of debt less stressful.

Trustees are one of the only debt professionals that can offer a full range of debt relief options and they can guarantee legal protection from creditors.